Presented by Richard Mangiameli

When we started working, one of the biggest surprises of our young adult life was the difference between our gross and net paycheck! We were introduced to the world of Income Tax withholdings.

Forty or so years later, we get the next biggest surprise – not having enough money to retire with! Again, the difference between our gross and net

retirement paycheck. Retirees are concerned about their retirement income being under siege with expenses, mandatory medical spending, lifestyle and outliving their money. This is an area where you, as an insurance professional, can protect your clients and help them with product solutions.

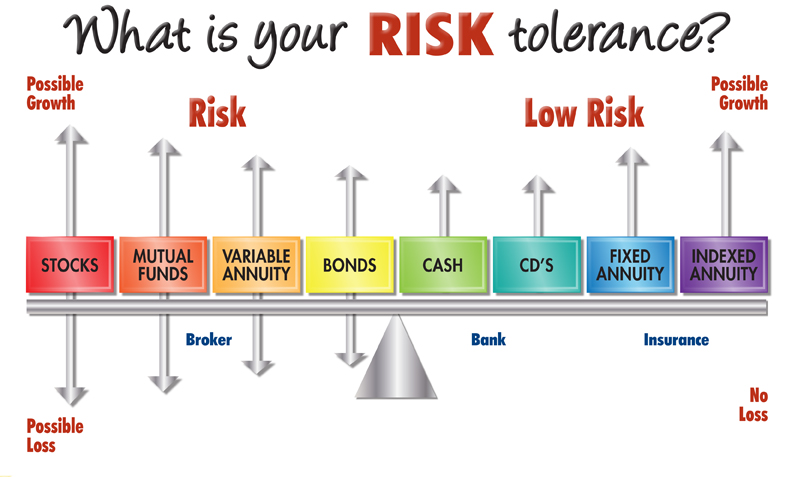

A clear view of the current trends in the retirement landscape will take you a long way toward finding the product to provide the solution. For example, the big focus today is the need for guaranteed income for life, without the fear of losing control. With fewer company pension plans and increasing life expectancy, retirees face a growing gap between income they can count on and expenses they expect to face. Fixed Index Annuities can offer predictability, no direct downside market risk, and the potential for guaranteed income for life – an attractive benefit to clients searching for ways to leverage assets and build a more stable future.

After the 2008 market crash, many people found their financial foundation was not as sturdy as they once thought. With the risk of longevity, medical expenses and inflation affecting retirement income calculation, many are looking for ways to supplement their income, accumulate assets and cover basic living expenses in the future. The opportunity to have upside potential, with no downside risk, provides your clients with peace of mind for long-term financial security, asset accumulation and can provide guaranteed income for life.

Fixed Index Annuities with an Income Rider can offer the “peace of mind” benefits that retirees are looking for today. If you need to know more about how the Fixed Index Annuities with Income Riders work, call Richard Mangiameli, LUTCF, FSS, at 800-397-9999.