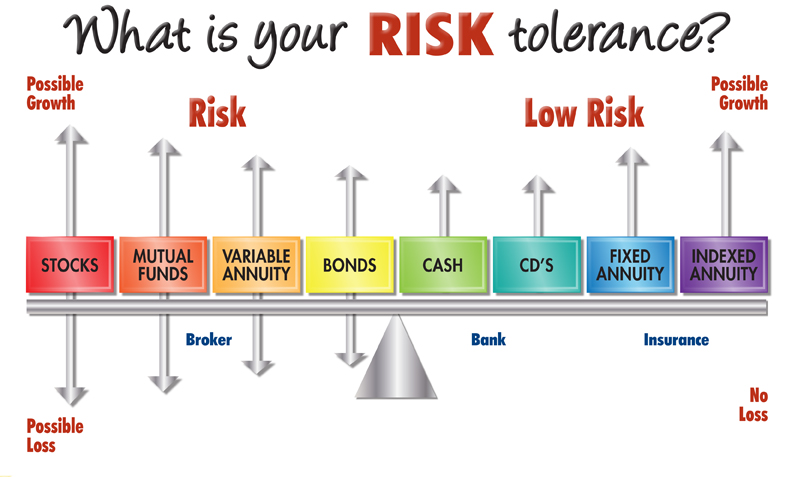

Everyone has a different point of view when it comes to risk tolerance. Over the years, I have found there are things that clients may need to make them comfortable when investing their hard earned money. It always helps to have the following characteristics to persevere in the market place:

Patience = To be able to ride out the market and give it time to work properly.

Courage = To allow yourself to stay with your conviction of doing the right thing with your money.

Confidence= Knowing you have made the right choice!

Fixed annuities are a great fit in so many different situations and can give your clients tremendous

confidence in their decision. Call me today to discuss how you can give your clients the confidence they’ll need in their financial future.

Deb Strong, Annuity Sales Manager – 800.397.9999

Annuities

Annuities

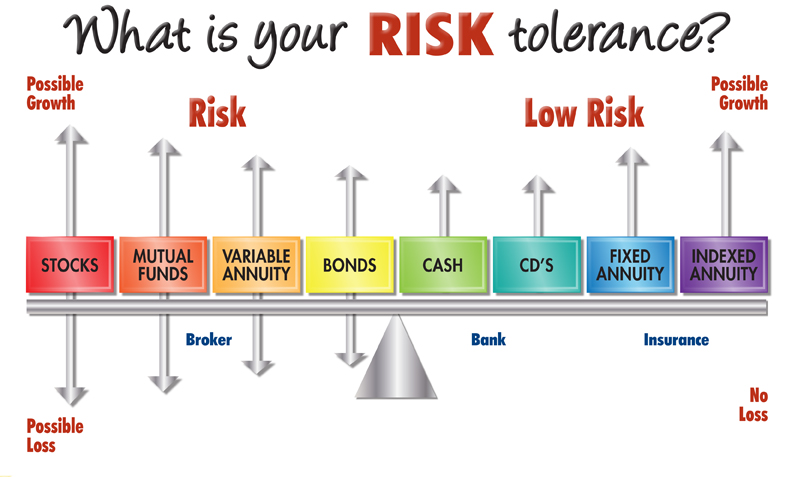

Everyone has a different point of view when it comes to risk tolerance. Over the years, I have found there are things that clients may need to make them comfortable when investing their hard earned money. It always helps to have the following characteristics to persevere in the market place:

Patience = To be able to ride out the market and give it time to work properly.

Courage = To allow yourself to stay with your conviction of doing the right thing with your money.

Confidence= Knowing you have made the right choice!

Fixed annuities are a great fit in so many different situations and can give your clients tremendous confidence in their decision. Call me today to discuss how you can give your clients the confidence they’ll need in their financial future.

Deb Strong, Annuity Sales Manager – 800.397.9999

Everyone has a different point of view when it comes to risk tolerance. Over the years, I have found there are things that clients may need to make them comfortable when investing their hard earned money. It always helps to have the following characteristics to persevere in the market place:

Patience = To be able to ride out the market and give it time to work properly.

Courage = To allow yourself to stay with your conviction of doing the right thing with your money.

Confidence= Knowing you have made the right choice!

Fixed annuities are a great fit in so many different situations and can give your clients tremendous confidence in their decision. Call me today to discuss how you can give your clients the confidence they’ll need in their financial future.

Deb Strong, Annuity Sales Manager – 800.397.9999