Brought to you by David Corwin

Indexed Annuity Contract Features will have an effect on Annuity Performance? Before purchasing an indexed annuity, it is important to understand various contract features and their potential impact on annuity performance.

The Index Indexed annuities credit interest based on the movement of the stock market index to which the annuity is linked. A market index tracks the performance of a group of stocks representing a specific market segment or the entire stock market. The S&P 500 is the index most commonly used for this purpose. Another index, however, may be used, such as the Dow Jones Industrial Average, NASDAQ 100 or Russell 2000. It is important to understand that when you buy an indexed annuity, you are purchasing an insurance contract and not shares of any stock or index.

Indexing Method An indexed annuity earns a minimum rate of interest and then offers the potential for excess interest earnings based on the performance of the index to which the annuity is linked. The indexing method is the approach used to measure the amount of change in the index and, as a result, has a direct impact on the potential growth of an indexed annuity.

Participation Rate The participation rate determines how much of the increase in the index will be credited to the indexed annuity. The participation rate is usually less than 100%. For example, if the S&P 500 increases by 10% and the participation rate is 80%, the indexed annuity would be credited with 8%. The insurance company may have the right to change the participation rate from year to year or when the annuity is renewed for a new term.

Margin/Spread/Administrative Fee Some indexed annuities subtract a specific percentage from the calculated change in the index before crediting interest to the contract. This “margin,” “spread” or “administrative fee” which may be charged instead of, or in addition to, a participation rate, is subtracted only if the change in the index produces a positive interest rate.

Index Term This is the period over which index-linked interest is calculated and/or the length of time during which withdrawals or surrenders are subject to a charge.

Cap Rate Some indexed annuities put a cap or maximum on the index-linked interest that will be credited to the annuity. For example, if the market index increases 20% and the annuity has a 15% cap rate, only 15% will be credited to the annuity. Not all annuities have a cap rate.

Floor This is the minimum guaranteed interest that will be credited to the annuity. This guarantee is based on the claims-paying ability of the issuing insurance company.

Averaging Some indexed annuities use an average of the changes in the index’s value rather than the actual value of the index on a specified date.

Interest Compounding Some indexed annuities pay simple interest during the index term, while others pay compound interest, meaning that index-linked interest that has already been credited to the contract during the term also earns interest in the future.

Exclusion of Dividends In measuring index gains, most indexed annuities count only equity index gains from market price changes and exclude any gains from dividends.

Vesting In some indexed annuities, none or only part of the index-linked interest is credited to the contract if the annuity is surrendered before the end of the term. The combination of these policy features found in any particular indexed annuity will make a difference in the amount of money your annuity investment will earn and in the amount of money you will receive if you surrender the annuity early. As a result, before you purchase an indexed annuity, it is important that you fully understand the various features in the contract you are considering.

Annuities

Annuities

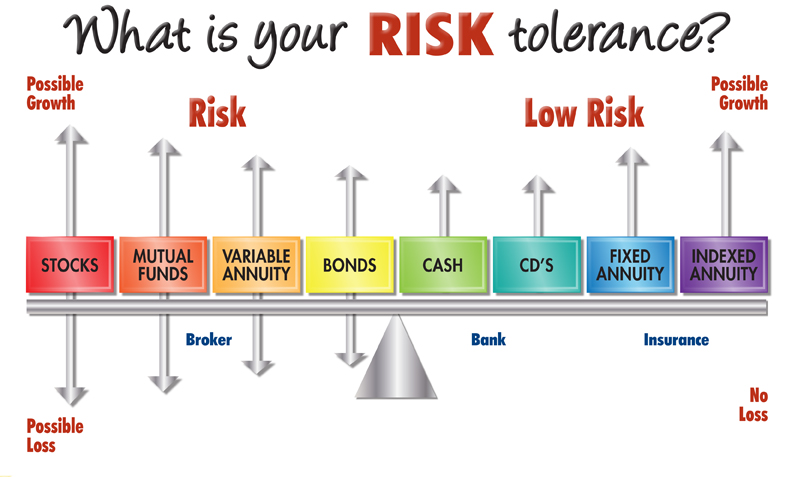

Everyone has a different point of view when it comes to risk tolerance. Over the years, I have found there are things that clients may need to make them comfortable when investing their hard earned money. It always helps to have the following characteristics to persevere in the market place:

Patience = To be able to ride out the market and give it time to work properly.

Courage = To allow yourself to stay with your conviction of doing the right thing with your money.

Confidence= Knowing you have made the right choice!

Fixed annuities are a great fit in so many different situations and can give your clients tremendous confidence in their decision. Call me today to discuss how you can give your clients the confidence they’ll need in their financial future.

Deb Strong, Annuity Sales Manager – 800.397.9999

Everyone has a different point of view when it comes to risk tolerance. Over the years, I have found there are things that clients may need to make them comfortable when investing their hard earned money. It always helps to have the following characteristics to persevere in the market place:

Patience = To be able to ride out the market and give it time to work properly.

Courage = To allow yourself to stay with your conviction of doing the right thing with your money.

Confidence= Knowing you have made the right choice!

Fixed annuities are a great fit in so many different situations and can give your clients tremendous confidence in their decision. Call me today to discuss how you can give your clients the confidence they’ll need in their financial future.

Deb Strong, Annuity Sales Manager – 800.397.9999