Annuities

Annuities

“Mailbox Money”

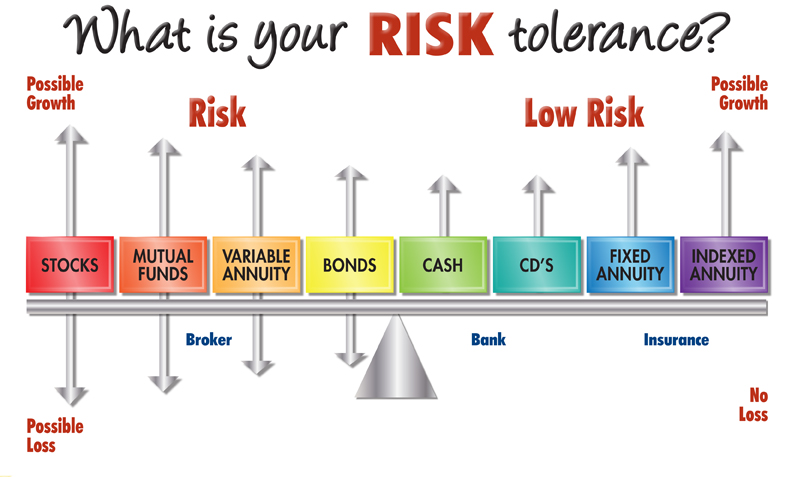

Presented by David Corwin Living too long is a risk that many seniors are faced with today. Studies show that a 65 year-old man has a 34% chance of living to age 90 and a 17% chance of making it to 95. A 65 year-old woman has a 44% chance of living to age 90 and a 23% chance of reaching 95. These longer life spans present wonderful blessings, but difficult challenges with the real risk of running out of their savings they have worked a lifetime to create. Annuities can provide a lifelong check directly to their “mailbox” to help mitigate the risk of running out of money. I can help you position one of the products below to best fit your client’s needs:- Single premium immediate annuity (SPIA) – this annuity offers an income for life or a certain period of time to be paid out. Often a good fit to cover the time between retirement and social security payments (and other scenarios), but the client does give up “control” of the lump sum asset in return for a potentially larger payout than other types of annuities.

- Fixed annuity – this annuity still gives the client 100% control over the asset, which means they can withdraw money as needed, but how long it lasts is dependent upon withdrawals and interest gained on the contract. Generally speaking, 10% penalty free amounts are withdrawn so additional fees and charges aren’t incurred. The drawback would be that income will not last for life, unless annuitized, which of course forces the annuitant to give up control of the asset.

- Income rider – this is a rider that is available on most indexed annuities. These seem to be the most popular because many contracts guarantee a future result. The client still has complete control of the asset while also knowing they can have “mailbox money” for life.