By David Corwin, Annuity Sales Manager

Many agents have yet to hear about QLACs, but most certainly many of their older clients need to be made aware. QLACs can be a key piece to proper retirement planning and can help clients facing Required Minimum Distributions (RMDs) from their qualified retirement accounts and the associated taxes that go with those distributions. QLACs are purchased within a traditional retirement plan and the annuity payments are deferred until the client is much older (they must begin payments the month following the month in which the client reaches age 85) and the value of the QLAC is excluded from RMDs and until payments begin. Some benefits include:

- Potentially reduce taxes

The ruling allows you to use 25% of your individual retirement account, IRA, or $125,000, whichever is less, to fund a QLAC. That dollar amount is excluded from your required minimum distribution, RMD, calculations, which could potentially lower your taxes.

- Lessen your RMDs

As an example, if you have a $500,000 Traditional IRA, you could fund a $125,000 QLAC under the current rules. Your RMDs (Required Minimum Distributions) would then be calculated on $375,000.

- Plan for future income

QLACs allow you to defer as long as 15 years or to age 85, and guarantees a lifetime income stream regardless of how long you live.

- Spousal and non-spousal benefits

Legacy benefits for both spouse and non-spouse beneficiaries guarantee that all the money will go to your family, not the annuity carrier.

- Protect your principal

QLACs are longevity annuity structures, which are fixed annuities. Also referred to as deferred-income annuities (DIAs), the QLAC structure has no market attachments, and fully protects the principal.

- Add a COLA

Depending on the carrier, you can attach a contractual COLA (cost-of-living adjustment) increase to the annual income or a CPI-U, Consumer Price Index for All Urban Consumers, type increase as well.

- No annual fees

QLACs are fixed annuities, and have no annual fees. Commission to the agent are built into the product, and very low when compared with fully-loaded variable or indexed annuities.

- Contractual guarantees only

QLACs are pure transfer of risk contractual guarantees, and agents cannot project different proposal/illustrations.

- Laddering income

Because of the QLAC premium limitations, this strategy should be used as part of your overall income laddering strategies, and in combination with longevity annuities in non-IRA accounts.

- No indexed or variables allowed

Variable and indexed annuities cannot be used as a QLAC; only the longevity annuity structure is approved under the QLAC ruling.

- Compliments Social Security

QLACs work similarly to your Social Security payments by guaranteeing a lifetime income stream starting at a future date.

- Indexed to inflation

The QLAC ruling allows the premium amount to be indexed to inflation. That specific amount is $10,000, and should increase by the amount every three to four years.

- Only the big carriers play

Because of the reserve requirements to back up the contractual guarantees, only the large carrier names most people are familiar with will offer the QLAC version of the longevity annuity structure.

Annuities

Annuities

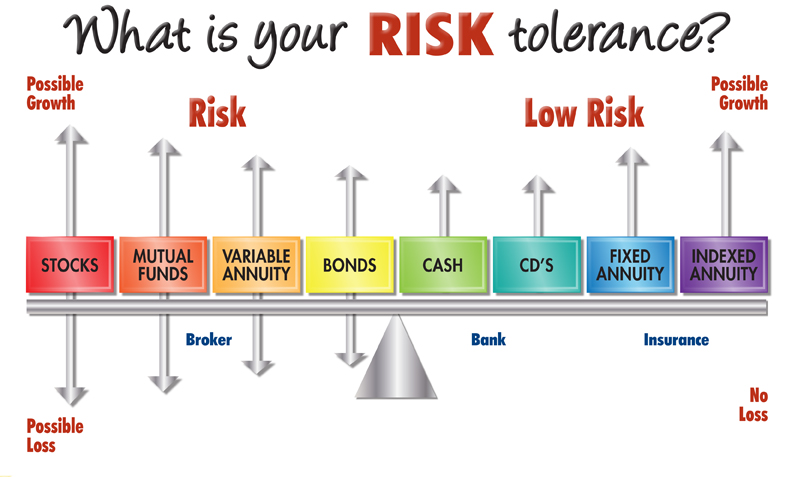

Everyone has a different point of view when it comes to risk tolerance. Over the years, I have found there are things that clients may need to make them comfortable when investing their hard earned money. It always helps to have the following characteristics to persevere in the market place:

Patience = To be able to ride out the market and give it time to work properly.

Courage = To allow yourself to stay with your conviction of doing the right thing with your money.

Confidence= Knowing you have made the right choice!

Fixed annuities are a great fit in so many different situations and can give your clients tremendous confidence in their decision. Call me today to discuss how you can give your clients the confidence they’ll need in their financial future.

Deb Strong, Annuity Sales Manager – 800.397.9999

Everyone has a different point of view when it comes to risk tolerance. Over the years, I have found there are things that clients may need to make them comfortable when investing their hard earned money. It always helps to have the following characteristics to persevere in the market place:

Patience = To be able to ride out the market and give it time to work properly.

Courage = To allow yourself to stay with your conviction of doing the right thing with your money.

Confidence= Knowing you have made the right choice!

Fixed annuities are a great fit in so many different situations and can give your clients tremendous confidence in their decision. Call me today to discuss how you can give your clients the confidence they’ll need in their financial future.

Deb Strong, Annuity Sales Manager – 800.397.9999